Spain Tax Refund Process: A Comprehensive Guide for Savvy Travelers

This comprehensive guide will walk you through the intricacies of claiming your VAT (Value-Added Tax) refund, ensuring a smooth and rewarding experience.

Being a seasoned, light carry-on traveler, I rarely have room to shop and take advantage of the Tax Refunds / VAT. However, on our last journey which was a month in Spain, I took a larger suitcase and decided to do some fun shopping for clothes and gifts that I can’t find in the USA. And it racked up $$$! What I learned is different from city to city, and specifically in Barcelona, I was able to start the easily go through the Spain Tax Refund Process before I even got to the airport at El Corte Inglés. It was a cinch (if you are prepared) but it’s essential to be aware of the Spain tax refund process to maximize your savings.

Spain Tax Refund Process Step by Step

Step 1: Shop at Participating Stores

Begin your shopping journey by identifying stores that participate in the Tax Free Shopping program. These stores will prominently display the Tax Free logo, indicating their involvement in the refund program. You can also just ask if they offer tax-free shopping.

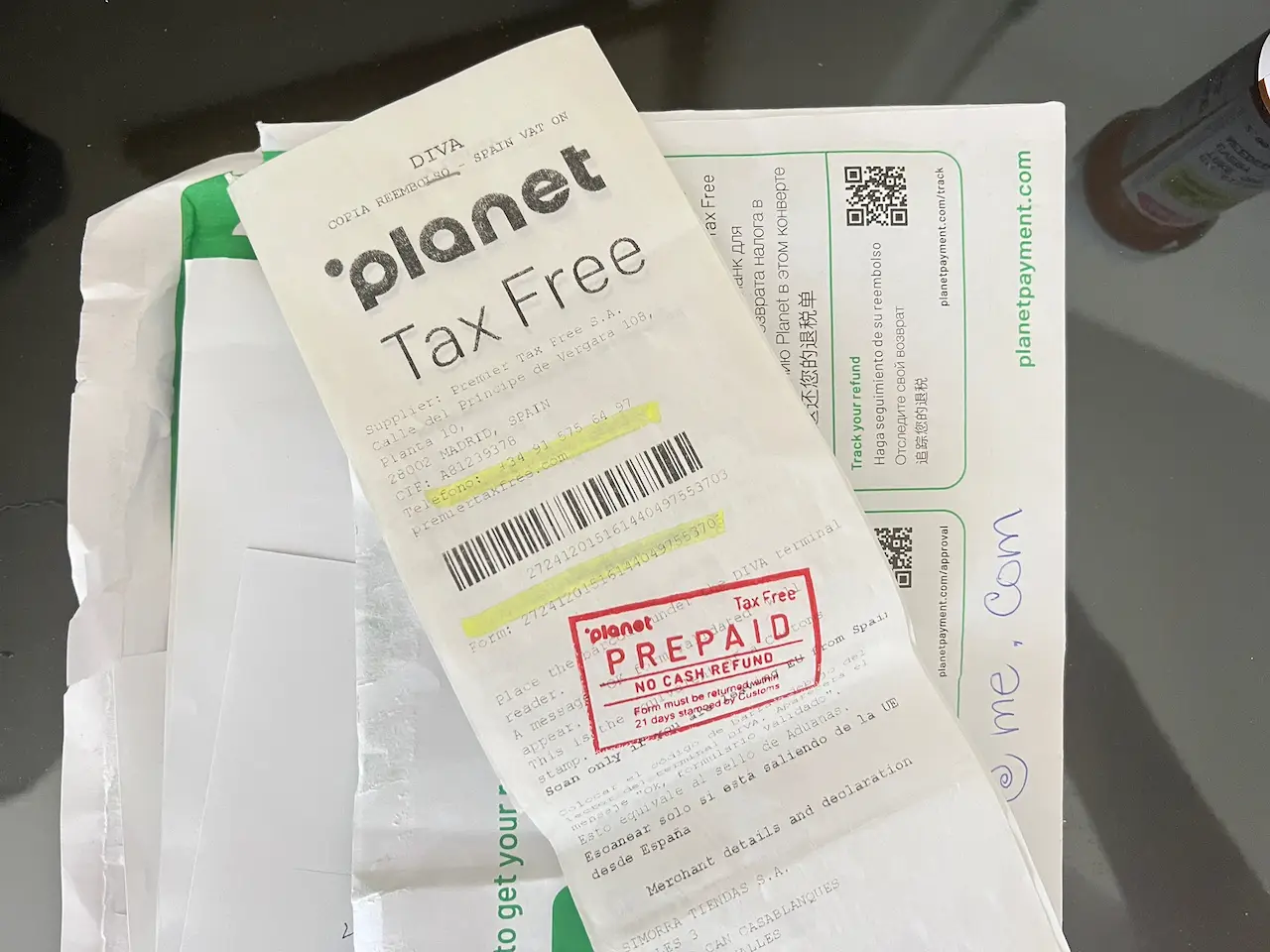

Step 2: Fill Out the DIVA Form for Your Spain Tax Refund

Once you’ve made your purchases, request a Tax Free form from the cashier. This form, known as the DIVA (Documento Interactivo para la Devolución del Impuesto), is crucial for claiming your Spain Tax Refund. In the shops where I purchased items, they had the whole system set up in their computer and completed the forms for me as part of the transaction. Just be sure you have your passport copy or photo with you! You don’t need the original. If you do fill it out yourself, be sure it’s legible.

Step 3: Securely Keep the DIVA Form and Purchase Receipts for your Spain Tax Refund

Keep everything organized. Safeguard the DIVA form and the corresponding purchase receipts. These documents will be essential when requesting your VAT refund at the airport, or at El Cortes Ingles which I’ll explain further along.

Step 4: Option 1 – Go to El Corte Inglés in Barcelona’s Central Plaza

This massive and amazing multilevel department store includes everything from the finest wines to kitchen goods, furniture and haute couture is where you’ll find Planet, the VAT counter that can process your receipts for your Spain Tax refund BEFORE you get to the airport. You MUST make sure that you have your original passport, the credit card you want the refund to go to, and the original receipts along with the completed forms. It’s on the lowest level near the gourmet food department. They are extremely helpful and will provide further instructions for processing the final refund at the airport. Note: If you do NOT complete the process at the airport, you will not receive your refund, and you may also get a penalty on your credit card.

Step 4: Option 2 – (do everything at the airport instead) Validate Your DIVA Form at Customs for Your Refund

Upon reaching the airport or port, proceed to the customs office before exiting Spain. Present your DIVA form, purchase receipts, and passport for validation. The customs officer will stamp the form, authorizing your refund request.

Step 5: Claim Your Spain Tax Refund at the Airport or Port

Locate a Global Blue or Premier Tax-Free refund office within the airport or port. These offices are designated for processing VAT refund claims. They are also very helpful there and will direct you to the right counter or digital kiosk to finalize your process. If there isn’t a large tour group ahead of you, it’ll take under 10 minutes. Be sure to allow enough time before departure to complete your refund process.

You might also find the Global Blue a bit faster

Some Common FAQs for the Spain Tax Refund

Q1: What is a Spain tax refund?

A: A Spain tax refund is a way for visitors to Spain to reclaim a portion of the Value-Added Tax (VAT) they paid on goods purchased during their visit. VAT is a tax that is added to the price of most goods and services in Spain.

Q2: Who is eligible for a Spain tax refund?

A: To be eligible for a Spain tax refund, you must be a non-EU resident who has purchased goods in Spain for personal use with a total value of over €90. You must also have your passport and a completed DIVA form.

Q3: How do I get a Spain tax refund?

A: There are two ways to get a Spain tax refund:

-

At the airport: Upon reaching the airport or port, proceed to the customs office before exiting Spain. Present your DIVA form, purchase receipts, and passport for validation. Once validated, you can claim your refund at a Global Blue or Premier Tax Free refund office within the airport or port.

-

At El Corte Inglés: El Corte Inglés is a popular department store chain in Spain that offers the option to process your Spain tax refund before you get to the airport. To do this, you must visit the Planet counter on the lowest level of El Corte Inglés and present your completed DIVA form, original passport, and credit card statement.

Q4: How much can I get back?

A: The amount you can get back depends on the total value of your purchases and the VAT rate for the goods you purchased. The standard VAT rate in Spain is 21%, but there are also reduced rates for certain goods and services.

Q5: How long does it take to get my refund?

A: It typically takes 2-3 weeks to receive your Spain tax refund. However, it may take longer if your refund is processed by mail.

Additional tips:

- Keep all of your purchase receipts and the DIVA form in a safe place.

- Allow ample time for processing your refund, especially during peak travel periods.

- If you have any questions, you can contact the customs office at the airport or port where you will be exiting Spain. Hotel concierges are another great resource to help you.

Summary

As you conclude your Spanish shopping spree, don’t forget to take advantage of the Spain tax refund process and reclaim a portion of the VAT you paid on your purchases. By following the steps outlined in this guide, you can seamlessly navigate the system and maximize your savings. Whether you’re a seasoned traveler or embarking on your first international shopping adventure, this guide will empower you to unlock Spain’s tax refund secrets and make your shopping experience even more rewarding.

So, pack your bags, embrace the vibrant shopping scene of Spain, and let this guide be your key to maximizing your savings and reclaiming a portion of your spending. Happy shopping and refunding in Spain!

You might also enjoy reading: